You may think donating your automobile in 2024 was a simple act of generosity, but when you wade into 2025's tax time, you are about to find a delightful key.

You will discover that the IRS has distinct principles On the subject of car donations, making certain your generous act also provides a tax crack. This isn't A fast trick; it is a matter of figuring out the nuances of The interior Income Company regulations.

Planting the mustard seed During the midst of grief, one particular spouse and children started a journey to healing by serving with Habitat. Donating their household motor vehicle into the Cars and trucks for Houses method is their most current phase. Browse a lot more

Try to be informed that the tax Positive aspects out of your donation depend mainly on your own taxable income as well as gross marketing price of the donated auto.

The Group also provides a spiritual component. It accepts most cars as donations, even design tools, and while your car doesn’t ought to be operating, it need to be in a single piece and possess 4 inflated tires so it can be moved.

When Irene and Dennis Moore get to the conclude of your highway with their automobiles and choose to switch them, the few doesn’t trade them in; they roll them in excess of to your American Red Cross.

Automobile donations are tax deductible. You may normally deduct your automobile’s worth if you include your donation in the charitable contribution deduction.

In addition, scrutinize any paperwork connected to your donation. Unscrupulous organizations may perhaps inflate your car's value to offer higher tax deductions, but this may check here lead to issues While using the IRS.

"Black Classical BMW 535i Chassis from 1990. It works and drives. Manual transmission. I'm here donating this car to St Jude Children's Clinic for the reason that my wife is a most cancers survivor. We recognize what read more It can be want to be Unwell and in a position in which you have to worry about your finances when you ought to be worrying in regards to the wellness get more info of your respective liked a person.

In 2025, you can explore a tax break secret that's switching the sport for car or truck donors like on your own. The car donation deduction is way over an easy charitable gesture; it's a strategic shift that could noticeably lower your tax bill. Your donated vehicle, as soon as an idle asset, gets to be a essential player in maximizing your tax cost savings.

Examples of needs granted consist of remaining a firefighter for a day, seeing the snow for the first time and Assembly a unicorn.

In 24 hours of the following company working day, we Get hold of you to definitely program and set up your absolutely free towing. We arrive at you and get your donated motor vehicle free of charge.

The tax Positive aspects you may get are considerable. The IRS now lets you have a deduction for your reasonable current market worth of your vehicle, which could noticeably reduce your tax Invoice.

The quantity that's tax deductible is definitely the sale cost of the car. For more information on get more info tax write-offs, we advise you evaluation IRS Publication 526 which sets forth how the IRS requires you to determine the worth of your respective donated residence. What do I should donate my car or truck?

Alisan Porter Then & Now!

Alisan Porter Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Rachael Leigh Cook Then & Now!

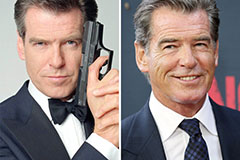

Rachael Leigh Cook Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!